Is Your Money Truly Worth Your Time? A Guide to Budgeting

Written on

Understanding the Time-Money Equation

The adage "time is money" is one we frequently encounter. This mindset emphasizes the financial value of our hours, urging us to optimize efficiency to maximize our output. While this perspective isn't inherently flawed, let's consider an alternative viewpoint: money equates to time.

We dedicate significant portions of our day—often over eight hours—to various forms of employment, whether hourly wages, salaried positions, or equity-based roles with fluctuating incomes. This time investment yields financial resources that allow us to pursue our desires, yet it raises an essential question: how should we budget our earnings? How can we assess the worth of a product or service beyond its objective price, focusing instead on its personal significance?

This is where the notion of money being time becomes relevant. Rather than merely viewing our time as valuable because of the money we earn, we can reverse this perspective and evaluate whether spending a specific amount of money is justified by the time it represents. This consideration elevates our understanding of time, a finite resource shared by everyone, regardless of wealth or background. While financial resources can be replenished, time remains limited to 24 hours a day for all.

The Simplified Budgeting Method

To begin, determine your hourly earnings. For hourly workers, this is straightforward—it's your pay rate. For salaried individuals, calculate your annual salary divided by the number of hours you actually work. If you're in an equity-based role, consider last year’s earnings or projected income for a more accurate estimate.

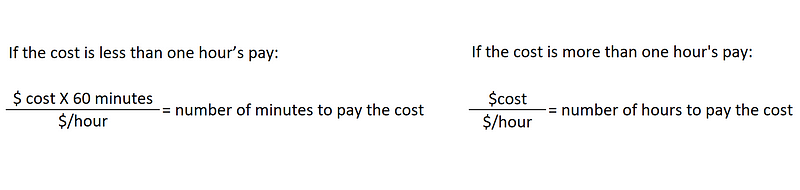

For instance, let's assume you earn $28 per hour and are contemplating a $5 coffee. To evaluate this purchase, multiply the item's cost by 60 (the number of minutes in an hour) and divide by your hourly wage. In this scenario, purchasing the coffee costs approximately 10.7 minutes of your work time.

It’s crucial to reflect on this outcome: is that coffee worth 10.7 minutes of your labor? This calculation varies by individual; some may find the purchase worthwhile, while others may not.

The beauty of this time-centric budgeting method is its adaptability. Each person assigns different values to their time, making this approach universally applicable while still allowing personal discretion. For some, spending 10.7 minutes for a cup of coffee could be a fair trade, while others might see it differently.

"This budgeting technique transcends currency, costs of living, and social status, as all considerations used in these calculations are individualized to you."

Another Example

If you earn $40 an hour and are considering a $200 day trip with friends, divide the trip cost by your hourly wage to determine its time equivalent. This particular trip would require five hours of work to cover the expense.

The Preferred Budgeting Method

However, a significant flaw in the simplified approach is the assumption that all earned money is available for spending. While technically accurate, this oversimplification is financially imprudent. Ideally, you should allocate 20-30% of your earnings to savings, and consider essential expenses like food and housing.

Using the previous example, if you earn $28 per hour but allocate 70% of your income to savings and necessities, you’re left with only 30% for discretionary spending. This translates to $8.40 for every hour worked. Consequently, that $5 coffee now costs you about 35.7 minutes of labor—an adjustment that alters your perception of its value.

When factoring in necessary expenses, consider the portion of your earnings allocated to savings and fixed costs. This more nuanced approach provides a clearer picture of how much your purchases truly cost in terms of time.

Time is indeed money, but it's also vital to recognize the inverse. By reevaluating the familiar adage, we can establish a more profound understanding of whether a purchase justifies the time it consumes. This budgeting method is not just about financial figures; it is a personalized strategy that reflects your unique circumstances.

So, the next time you find yourself debating a purchase, think about its worth in terms of your time. Make decisions grounded in the one resource we cannot replenish.

Happy spending!

This video discusses the misconception that "time is money" and explores the true value of time in our lives.

Discover the real worth of your time and how it impacts financial decisions in this insightful discussion.