Understanding the Impending Recession: Insights and Indicators

Written on

Chapter 1: The Recession Reality

Concerns about an impending recession are mounting. The prevailing sentiment has shifted to a focus on "when" it will occur rather than "if." Recent surveys reveal that over 60% of global CEOs anticipate a recession within the next 12 to 18 months.

In retrospect, it seems evident that the Federal Reserve's actions over the past two years, which aimed at stimulating the economy, are now necessitating a reversal that may lead to challenging times. We were somewhat blinded by the economic boom.

In March, two significant recession indicators raised alarms. The yield curve exhibited signs of inversion, and energy prices surged dramatically. Fast forward three months, energy prices remain elevated, and the yield curve has once again approached inversion.

To better understand the timing of a potential recession, it’s essential to examine various indicators.

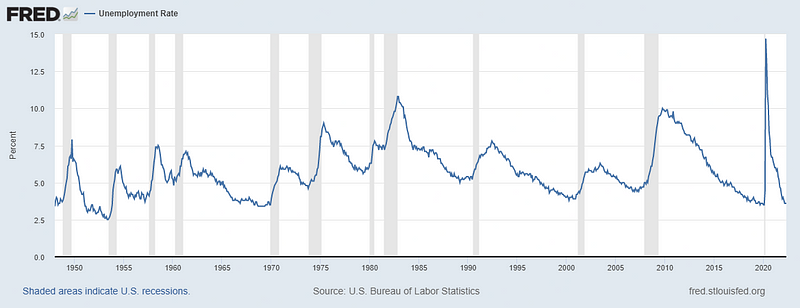

Section 1.1: Unemployment Rate Analysis

The unemployment rate is a crucial metric to monitor.

Below is a chart depicting the unemployment rate in the United States, with gray bars highlighting periods of recession.

According to data from the Federal Reserve Bank of St. Louis, it is evident that during recessionary periods, unemployment tends to rise. The cyclical nature of unemployment rates is notable.

A key takeaway from this analysis is that unemployment rates were notably low leading up to previous recessions. While the unemployment rate isn't a foolproof indicator of a recession—since it can remain below 4% even as the economy contracts—any sustained dip below this threshold should raise concerns.

Historically, six out of twelve recessions have occurred when the unemployment rate was below 4%, including two of the last three. Currently, the unemployment rate stands at 3.6%. Economists caution that excessively low unemployment can lead to inflationary pressures and reduced productivity.

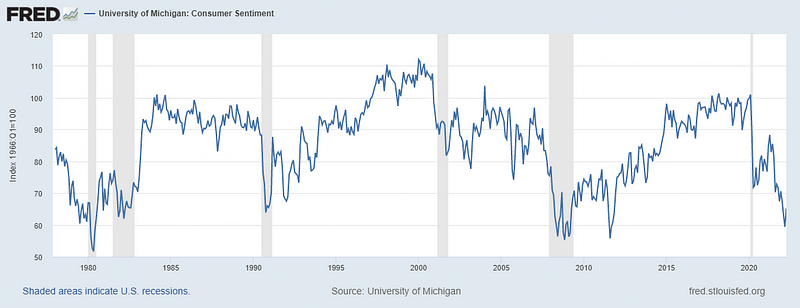

Section 1.2: Consumer Sentiment Insights

Consumer sentiment, measured monthly by the University of Michigan, gauges public perceptions of the economy, personal finances, and overall business conditions. Presently, this sentiment is at its lowest point in over a decade.

While there isn’t a definitive value that signals the start or end of a recession based on consumer sentiment, a significant observation emerges: the lowest readings often occur during recessions. This suggests that public perception tends to predict economic recovery ahead of GDP data, which is typically delayed.

The collective belief that the economy will either improve or deteriorate can sometimes manifest into reality, echoing the concept of "speaking things into existence."

Chapter 2: Investment Strategies During Economic Downturns

The first video titled "Looming Recession" explores the signs of an impending economic downturn and what it means for businesses and consumers alike.

The second video, "What's Coming Is WORSE Than a Recession" - Jeremy Grantham's Last WARNING, provides insights into the potential challenges ahead and strategies for navigating economic uncertainty.

One notable indicator shared by John Gobins is the occurrence of new 52-week lows in the stock market, which can signal opportune moments for investment. Recently, Gobins pointed out that there were over 1,000 new 52-week lows, suggesting it might be time to consider entering the market.

While traditional advice during a recession often includes conserving cash and avoiding job changes, there are times when taking calculated risks—such as accepting a higher-paying job or investing in undervalued stocks—can lead to significant financial rewards.

In the end, everything works out. If it hasn't worked out yet, it's not the end.

Good luck navigating these uncertain times.