The Banking Ambitions of Apple: A New Chapter Unfolds

Written on

Chapter 1: Apple’s Financial Aspirations

Apple, valued at $3 trillion, could easily rest on its laurels, yet it continually seeks new avenues for revenue. While the company is widely recognized for its iPhone, it also stands as a tech leader with a suite of products including the iPad, Apple Watch, and Mac. However, with sales growth slowing, Apple has shifted its focus towards expanding its business model, venturing into film production and enhancing its service offerings.

This paragraph will result in an indented block of text, typically used for quoting other text.

Section 1.1: Cost-Cutting with Caution

The tech industry is facing challenges, but Apple has strategies in place to navigate these turbulent times. Despite their success, Apple is always looking for more. Recently, they have turned their attention to the financial sector.

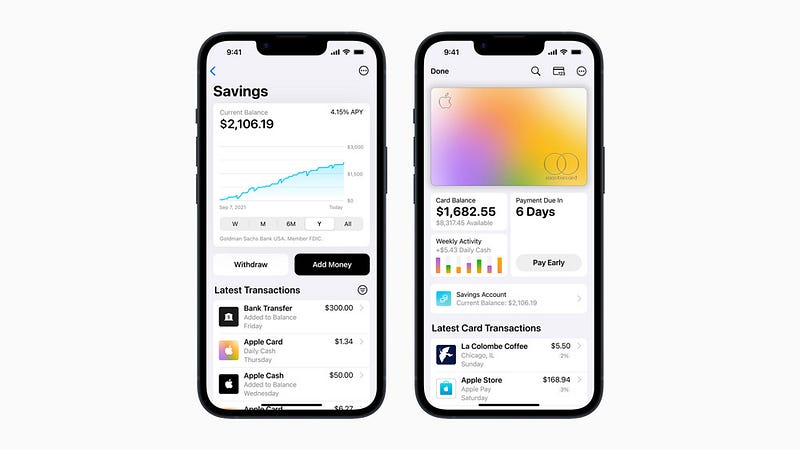

Apple's interest in financial services can be traced back to the introduction of Apple Pay in 2014, which revolutionized the way we make transactions. Nowadays, I rarely carry a physical credit or debit card, as Apple Pay offers unmatched convenience. In addition to Apple Pay, the company has gradually expanded its financial services portfolio with Apple Cash, Apple Card, and, most recently, the Apple Card Savings account.

Section 1.2: A New Financial Era?

With the stability of global markets in question, Apple seems poised to become a significant player in banking and finance. They understand that money often generates more money, and perhaps the banking industry could benefit from their innovative approach.

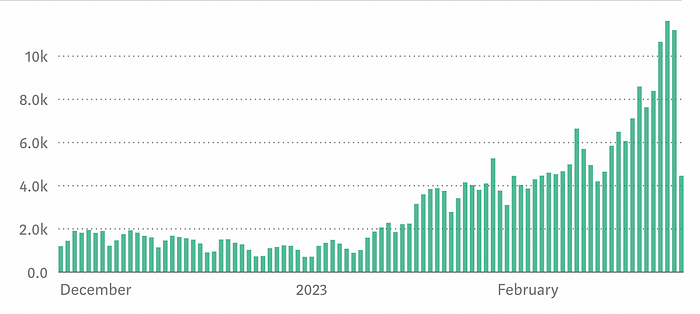

Apple's recent announcement of a high-yield savings account raised some eyebrows. Typically, offering interest on deposits means incurring costs, but Apple's account boasts a competitive interest rate of 4.15% with no minimum balance required. This raises the question: how does this model work for Apple?

Subsection 1.2.1: Making Money Work for Them

Apple has a strategy in mind. By providing attractive interest rates, they encourage customers to deposit money, effectively keeping those funds within their ecosystem. This creates a cycle where consumers are more inclined to use Apple Pay and the Apple Card, further increasing their financial assets. Although the savings account operates under the guidance of Goldman Sachs, it benefits Apple by ensuring that funds remain accessible for investment.

Chapter 2: The Future of Apple’s Financial Services

In the video "Steve Jobs Presents to the Cupertino City Council (6/7/11)," we witness the visionary leader discussing Apple's future plans, including their potential foray into new markets.

The second video, "What is Bill Cupertino & Why is it on my Bill?" sheds light on Apple's billing processes, adding context to their financial initiatives.

Apple's move to establish a financial division signifies their long-term commitment to the banking sector. This new venture is not just a fleeting trend; they likely have substantial plans for the future. The intersection of finance and technology is becoming increasingly relevant, as evidenced by the popularity of Apple Pay.

Wrapping Up: Apple's Financial Future

Reflecting on my research, it appears that Apple is keenly aware of the financial opportunities before them. With the success of Apple Pay and their new financial products, it’s reasonable to speculate on their ambitions in the banking sector. While we may not see an Apple Bank on every street corner soon, the gradual introduction of financial products will undoubtedly enhance their knowledge and capabilities.

As Apple prepares to launch new technologies, such as their headset, it's clear they are thinking about integrating banking into our daily lives. Apple often plays the long game, carefully planning each move to ensure success.