A Promising Future for Equity Crowdfunding Amid Market Turmoil

Written on

The Rise of Equity Crowdfunding

In light of the recent downturn in the stock market, many investors are seeking refuge for their capital. With the Nasdaq and S&P 500 experiencing some of their most challenging days, alongside significant drops in cryptocurrency values, including Bitcoin plummeting by nearly 60%, traditional investment options seem bleak. Even gold prices are slipping, leaving food and a handful of commodities as the only apparent winners in this economic climate. Compounding this issue, reports indicate a tightening of venture capital funding.

However, this challenging landscape might just herald a golden age for equity crowdfunding. For this sector to flourish, three crucial factors must align: startups seeking capital, investors willing to contribute, and startups providing returns to their backers. Current indicators suggest that these elements are converging favorably for equity crowdfunding.

Startups Seeking Capital

Despite a decline in venture capital investments, numerous startups are still actively looking for financial support. This trend is particularly evident as we emerge from a prolonged bull market that saw an abundance of available funding. Companies that previously thrived may now find themselves in a position where securing additional rounds of funding becomes increasingly difficult. As funding rounds shrink and fewer companies receive backing, many will turn to alternative financing methods, such as equity crowdfunding. This shift could enhance investor returns, stimulate portal growth, and bolster the industry's overall credibility.

Investors Ready to Invest

Equally vital to the success of this sector is the presence of investors prepared to allocate their funds. Even if leading startups in the United States pivot to equity crowdfunding, a lack of willing investors would render these efforts futile. Historically, the only downturn in equity crowdfunding since the JOBS Act's implementation was during the COVID-19 pandemic. Remarkably, 2020 turned out to be one of the most prosperous years for equity crowdfunding, significantly propelling the industry forward. In that year alone, $214.9 million was raised under Regulation Crowdfunding, a stark contrast to the $300 million accumulated from 2016 to 2019. This demonstrates a clear willingness to invest, even in times of economic uncertainty.

Further supporting this notion, the Vice President of Fundraising at Wefunder recently shared insights suggesting that the current market downturn is unlikely to dampen investor enthusiasm:

While this perspective isn't definitive, it does indicate that historical trends and insider insights may suggest that overall market performance won't significantly impact investment behaviors. If I had to speculate, I believe inflation may pose a greater challenge to investments, as it directly affects disposable income. Should the Federal Reserve manage to raise interest rates and alleviate gas prices, it could provide more support than fluctuations in the stock market itself.

Startups Delivering Returns

One appealing aspect of investing in startups is the relative immunity to daily market fluctuations. Unlike many investors who are contemplating selling their stocks amid the NASDAQ's decline, I can focus on the long-term growth of my startup investments, which are experiencing remarkable increases—some as high as +22,800% year-over-year in revenue. As long as these companies continue to grow, I remain unconcerned with short-term market volatility. While an increase in share price during future funding rounds would be desirable, sustained growth will naturally lead to better valuations.

Investing in strong companies means they can choose their IPO timing, allowing them to wait for a more favorable market environment. While this might require investors to hold their positions for additional months or years, it promises a more substantial and hopefully more successful IPO when the time is right.

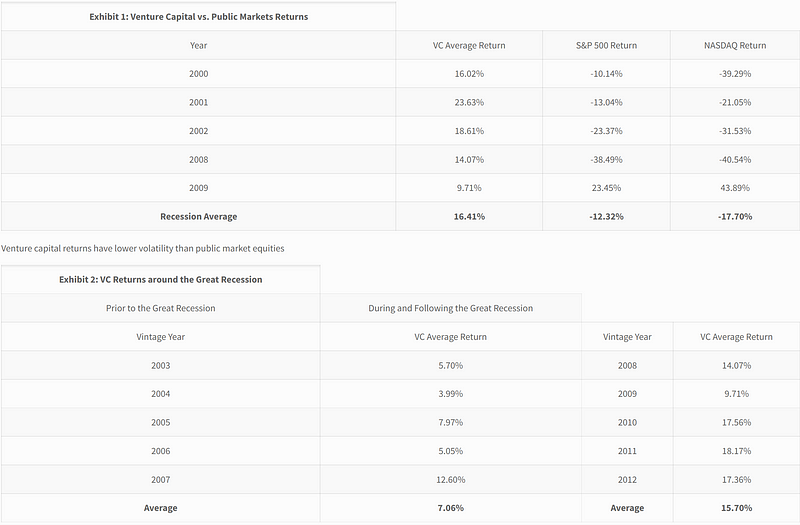

Because startups operate on longer timelines, they typically remain less affected by recessions. This positions startup investments as some of the best-performing assets during such economic downturns:

Research indicates that while fewer unicorns emerge during economic downturns, the rate of startups failing does not significantly increase. However, a reduction in venture capital funding during these times may contribute to the scarcity of unicorns. A study spanning nearly three decades reveals that only one year—1999—saw a negative return among a cohort of venture capital funds, with losses amounting to less than 2%. In contrast, many funds experienced declines of up to 40% during similar periods.

Conclusion

The convergence of these factors could signal the dawn of a promising era for equity crowdfunding. While the industry has shown resilience recently, the current market conditions may further enhance its prospects. An influx of high-quality investment opportunities and the need for a secure investment avenue could create an ideal environment for growth in equity crowdfunding.

The first video titled "The Stock Market Crash Of 2024 | What You Must Know" provides critical insights into the current market crisis and its implications for investors.

The second video, "Is The Market About to Correct?" discusses the potential for market corrections and how they may affect investment strategies going forward.